What is a Charitable Lead Annuity Trust (CLAT)?

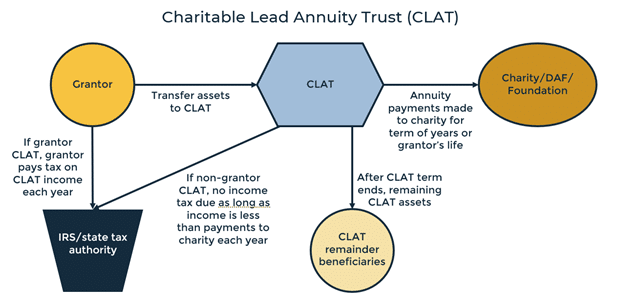

A charitable lead annuity trust (“CLAT”) is a type of charitable trust where a charity, donor advised fund, or foundation of the grantor’s choosing (the “Lead Beneficiary”) receives annual payments, either for a term of years or the grantor’s lifetime. At the end of this defined period, the remaining CLAT assets are distributed to the CLAT’s non-charitable beneficiaries, who are usually the grantor’s descendants, or trusts for the descendants’ benefit.

How do CLATs work?

For CLATs, the Lead Beneficiary receives fixed payments each year. The term of the CLAT may be for a fixed number of years or for the grantor’s lifetime. When the CLAT term ends, the remaining CLAT assets can be distributed to the grantor’s descendants, either outright or in continuing trusts for their benefit. CLATs provide a gift tax efficient way to transfer wealth to your heirs while benefiting charities.

Assume Jane contributes $1,000,000 to a CLAT that lasts for 10 years and pays 10.333% (or $103,330) annually to her favorite charity. With a 7520 Rate of 0.6%, and assuming average growth of 15% annually of the CLAT assets, the result would be as follows:

Charitable Benefits:

- Charity receives $1,033,300 ($103,330 per year for 10 years).

- Gift tax charitable deduction: $1,000,000.

Wealth Transfer Benefits:

- Taxable gift of $0 – Jane owed no gift tax and did not need to use any of her available gift tax exemption.

- At the end of 10 years, the remaining CLAT assets, totaling $1,947,000, are distributed to Jane’s descendants.

Income Tax Benefits:

- If Jane sets it up so that she pays the taxes on the CLAT’s income (a “grantor CLAT”), she gets an immediate income tax charitable deduction of $1,000,000 to use, starting the tax year when the CLAT was created with a 5 year carry-forward for any unused charitable deduction.

- If Jane sets it up so that the CLAT pays its own taxes, the CLAT gets an income tax charitable deduction each year, equal to $103,330 per year. Jane gets no income tax charitable deduction.

Are CLATs exempt from income tax? Is there an income tax charitable deduction?

Unlike charitable remainder trusts, CLATs are not exempt from income tax.

If the grantor wants to claim the immediate income tax charitable deduction, the CLAT must be set up as a grantor trust, so that all income generated by the CLAT during the trust term (even income distributed to the Lead Beneficiary) is taxable to the grantor. This is called a grantor CLAT. The income tax charitable deduction is equal to the present value of the payments the Lead Beneficiary will receive over the CLAT term. A CLAT is a grantor CLAT if the trust includes one of the grantor trust triggers, such as giving a non-adverse person other than the settlor the power in a non-fiduciary capacity to substitute trust assets with assets of equal value.

The extent to which a grantor can use the income tax charitable deduction in any particular year is limited to a portion of his or her total income for the year – up to 30% if the CLAT is funded with appreciated assets (but only 20% of AGI if the Lead Beneficiary is a private foundation). The good news is that in most cases, the grantor can claim unused portions of the deduction in up to 5 additional carry-forward years.

If the grantor obtains the income tax charitable deduction at the inception of the trust, the grantor must report and pay tax on all CLAT income (even amounts paid to the Lead Beneficiary) in subsequent taxable years on the grantor’s individual income tax return. Because the grantor already benefitted from the immediate income tax charitable deduction at the CLAT’s inception, she will not receive any more income tax charitable deductions during the CLAT term for the future payments made to the Lead Beneficiary. If a grantor decides to turn off the grantor trust power, the CLAT is no longer a grantor trust. The grantor will then be required to recapture a portion of the immediate income tax charitable deduction she previously obtained and will be required to include the recaptured CLAT income in her personal income tax return that year.

A CLAT may also be structured as a non-grantor trust. For the non-grantor CLAT, the grantor may not claim an income tax charitable deduction on his personal tax return; however, none of the income is taxable to the grantor on his personal income tax return. The CLAT is its own taxpayer but can claim a charitable deduction each year for payments made to the Lead Beneficiary that year. As long as the CLAT income in a given year does not exceed the payments made to Lead Beneficiary in that year, the CLAT will not owe income taxes.

When does it make sense to set up a CLAT?

A CLAT may make sense for high net worth individuals (>$20M) who want to make charitable gifts, while also transferring wealth to their heirs without using gift exemption.

CLATs work best in low interest environments and down markets. Each month, the IRS publishes a “hurdle” interest rate, called the 7520 rate. The lower the 7520 rate, the smaller the amount that must be paid to the Lead Beneficiaries, leaving more value in the CLAT at the end of the term for grantor’s descendants. For December 2020, the 7520 rate is 0.6%. In November, the 7520 rate was 0.4%, which was a record low. CLATs work well in a low interest rate environment because if the CLAT’s growth exceeds the 7520 rate, then this excess growth passes to the grantor’s descendants gift tax free. Also, the more undervalued the CLAT assets are at the time of funding, the more likely those CLAT assets will grow over the CLAT term when markets rebound. During the term, the more the CLAT growth exceeds the 7520 rate, the more wealth the CLAT will transfer to the next generation free of gift tax.

If you have significant and unusually high taxable income in a particular year, you can create and fund a grantor CLAT where you are the taxpayer for income tax purposes and benefit from an immediate income tax charitable deduction to lower your personal income tax bill that year. For example, your income tax bill may be unusually high in a year where you sold a business, received an unusually high bonus or commission, or took a large IRA withdrawal.

What assets should a grantor use to fund a CLAT?

The CLAT can initially be funded with high basis assets such as cash. To maximize wealth transfer benefits over the CLAT term, the CLAT should invest in securities or other assets with high potential for growth over time, or an asset that is considered grossly undervalued. Funding a CLAT with income-producing real estate or stock in a closely held family business is also a good option.

Can the Lead Beneficiary be changed at any time?

No, the Lead Beneficiary may not be changed. However, back-up Lead Beneficiaries may be named (in case the original Lead Beneficiary no longer qualifies as a charitable beneficiary), or the trustee may be given discretion to pick who the Lead Beneficiary should be if the original Lead Beneficiary no longer qualifies. The grantor should not have the power to change the Lead Beneficiary or decide how to divide the annual payments amongst multiple Lead Beneficiaries – if he does, the CLAT will be includible in the grantor’s taxable estate at death.

Can my private foundation be the Lead Beneficiary?

Yes, your private foundation can be the Lead Beneficiary. But there are inherent risks which require careful attention to avoid unintended tax consequences.

If a CLAT makes payments to a private foundation in which the grantor has too much control, the grantor may risk having the CLAT property included in her taxable estate at death.

Under the Internal Revenue Code, if a grantor transfers property but retains the right, either alone or in conjunction with another person, to designate the persons who will possess or enjoy the income, that transferred property is included in the person’s taxable estate. So, if the grantor creates a CLAT where a private foundation is the Lead Beneficiary, and the grantor has the power to direct the disposition of the private foundation’s funds, the value of the property transferred to the CLAT is at risk of being included in the grantor’s estate.

The CLAT and the private foundation must be carefully structured to limit the grantor’s involvement. If the grantor serves as a director or officer of the private foundation, the grantor should be prohibited from voting on matters concerning the funds the private foundation receives from the CLAT. Better yet, the grantor should not serve on the private foundation’s board of directors at all, but rather have his spouse or children serve on the board. Also, it is best if the grantor does not serve as Trustee of the CLAT.

Finally, it should also be noted that in 1988, there was a private letter ruling[i] in which the IRS took the position that when the CLAT Lead Beneficiary is a private foundation, the 5-year carry-forward for any unused income tax charitable deduction was not available. However, in 2000, the IRS issued a different private letter ruling which stated the 5-year carry-forward is available for a grantor CLAT with a private foundation as Lead Beneficiary. Most commentators agree that the 5-year carry-forward applies for contributions to any grantor CLAT, even those with a private foundation as Lead Beneficiary.

Finally, for grantor CLATs, the income tax benefits to the grantor (the amount of the immediate income tax charitable deduction and the AGI limits) may be reduced if a private foundation is named as Lead Beneficiary.

Who can be the trustees?

The grantor may name herself as trustee, as long as the trustee does not have power to direct how the annual payments are divided amongst multiple Lead Beneficiaries or to direct how payments received by the Lead Beneficiary should be used. The grantor’s family members may also be named as trustees, particularly if the CLAT asset is a closely held family business. The non-charitable beneficiaries (i.e. the CLAT’s remainder beneficiaries) may be trustees, but it may be best to also appoint a non-beneficiary to serve as co-trustee with them (this is required in some states).

Do I have to pay gift tax or use gift exemption when I set up a CLAT?

When funding a CLAT, the gifted amount is discounted by the present value of the payments that the Lead Beneficiary will receive over the CLAT term. Most CLATs are set up so that the present value of the charitable payments equal the amount gifted to the CLAT. Because the gift to the CLAT is offset by the gift tax charitable deduction (equal to the present value of amounts the Lead Beneficiary will receive), the grantor does not owe any gift tax or use any gift exemption when funding the CLAT. This is known as a zeroed out CLAT.

Is the CLAT includible in my estate?

By gifting assets to a CLAT, a grantor removes those assets from her taxable estate. The remaining CLAT assets passing to the grantor’s descendants at the end of the CLAT term are also not includible in the grantor’s taxable estate.

Further Information

To determine whether a Charitable Lead Annuity Trust can help you with your charitable, financial and estate planning goals, please contact your financial advisor, tax advisor, or estate planning attorney.

![Make sure your estate plan is kept up to date throughout your life. Learn how we can help you create and maintain your estate plan. [Button Text: Speak with an Advisor]](https://no-cache.hubspot.com/cta/default/3388819/67d97a86-9d11-4394-8bb8-2ab2af65863a.png)

Updated December 2020

Wealthspire Advisors LLC is a registered investment adviser and subsidiary company of NFP Corp.

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. © 2024 Wealthspire Advisors

[i] Private letter rulings (PLRs) are issued by the IRS upon taxpayer request for the tax consequences of a proposed transaction. A PLR applies to the taxpayer’s specific facts only and should not be relied upon as authority. PLRs are not precedential law but can provide insight into the IRS’ thoughts on a specific transaction. Reference to the PLRs here are for informational purposes only.