In this letter:

- A rush for the exits drains liquidity from most equity and fixed income markets resulting in a rapid and significant sell-off that rivals some of the worst we have witnessed in the past 100 years.

- A global pandemic ends one of the longest economic recoveries in U.S. history, with expectations of further pain ahead.

- Economist and market prognosticators search for parallels to provide context to COVID-19 but often lean on poorly drawn corollaries.

- Central Bank and Fiscal backstops are growing to the sky, in some ways already surpassing the response to the Great Recession.

- Markets do not equal economy. They differ in composition, participation, and maybe more importantly, timing.

What happened? In short, sparked by the continuing global COVID-19 pandemic and a forced government economic shutdown, buyers and liquidity virtually disappeared. At the first sign of stress in underlying market mechanics, there was a run for the exits across anything that could be readily sold.

What initially started in Treasury markets in early March quickly spilled over into agency mortgage-backed securities, investment grade municipals and corporates, and eventually into higher yielding parts of the market like bank loans, commercial real estate debt, and the like. Anything that does not trade on an exchange (e.g. most of fixed income) saw rapid price deterioration as outflows from funds put significant pressure on markets. Equities sold off even more, though companies with less debt on their balance sheets held up better than their indebted counterparts. Recognizing that markets were at risk of a meltdown, the Federal Reserve ultimately came in with liquidity to first solve for short-term financing needs, and then to take on a bigger piece as buyer of last resort. This helped stabilize markets, but much of the damage was already done.

The longest economic expansions in the post-war era undoubtedly ended in March with the country and much of the world going into quarantine. We will not see preliminary Q1 GDP data until the end of April and decent economic activity in January and February will help cushion the initial number. It is expected that Q2 economic data will be worse. In our 2019 Q3 commentary we reminded folks that a recession was not, in fact, two consecutive quarters of negative real GDP, but rather “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” We are seeing all of these play out today.

Upcoming economic releases will likely sound like hyperbole. Double digit unemployment and GDP declines are now baseline expectations. Most other data series will look equally as bad. The largest GDP decline since the Great Depression was 10% in Q1 1958. The economy today is roughly 70% personal consumption with nearly 20% of that in discretionary retail, recreation and associated services, gasoline, and transportation services. Those sectors also make up more than 20% of employment. So, be ready to hear this described as the worst since “the Great Depression”, or “since WWI”, or the “Spanish Influenza”, etc. Hopefully we will not hear anyone reference smallpox, cholera, or the bubonic plague.

“There is one adage that we remind ourselves – the stock market does not equal the economy. Simply, stocks tend to discount the future, whereas economic data is more about yesterday and today.”

Realistically, many of these comparisons are weak. The Spanish Flu of 1918-1920 which devasted the U.S. with a near 4% mortality rate and an estimated 675,000 deaths occurred pre-antibiotics (those weren’t really accessible until WWII). The vast majority of those lost during that time suffered from secondary bacterial (not viral) respiratory infections, today curable by antibiotics. The tremendous medical progress since then has given us vaccines, anti-virals, and genome decoding.

Those calling for this to be a repeat of the Great Depression are also leaning on poorly drawn parallels. Central banks are unlikely to repeat their mistakes. Ben Bernanke noted in a 2002 speech: “Regarding the Great Depression, …we did it. We’re very sorry…We won’t do it again.” The Fed was not a coordinated body during the Great Depression, as district governors set policies for their respective district. They actually raised interest rates in 1928 and 1929 and failed to be the lender of last resort during the banking panic in the early 1930s.

The Fed is already dusting off the playbook from the Great Recession (e.g. 0% interest rates, credit facilities, etc.), with a few new chapters such as support for corporate debt, muni markets, small businesses and others. The latest twist is essentially unlimited Quantitative Easing (QE). We acknowledge the moral hazard created by the ever-growing backstops and bailouts, which incentivizes inappropriate risk-taking behavior. Yet, at least for now, a better alternative is not apparent. The Fed has put forth a strong set of solutions that show it is willing to do whatever is required to support the economy.

A multi-trillion-dollar fiscal package suggests Congress is also recognizing the need to think big. A good summary of the legislation can be found on our blog. Government spending as a percentage of GDP will rise but is unlikely to fully cover the economic loss associated with shutting down the economy. In many respects, it is not intended to. It provides a means to sustain the bare minimum of economic activity until the virus slows and the country can come back online.

There is one adage that we remind ourselves – the stock market does not equal the economy. Simply, stocks tend to discount the future, whereas economic data is more about yesterday and today. Stock markets typically bottom three to nine months before the economy does, and the economy typically bottoms before we see notable employment gains. The composition is also different. We mentioned earlier the near 20% of employment tied to heavily impacted industries. Those same industries make up less than 8% of S&P 500 earnings. Lastly, a reminder that scarcely 50% of the U.S. population own any stocks.

Last quarter we wrote: “we suspect investing in the 2020s will be a wilder ride than in the decade just completed.” That may have been a bit too prescient. We have written several pieces in the last few weeks getting into our thoughts of underlying markets, opportunities, and risks. The underlying tone, however, has not changed. We do not encourage emotional reactions to markets, particularly when they are as volatile as they are today. It is important to have a plan, stick with that plan, and make sure you and your advisor are on the same page regarding your goals, timelines, and risk-tolerances.

Markets

Expectations Fully Tempered

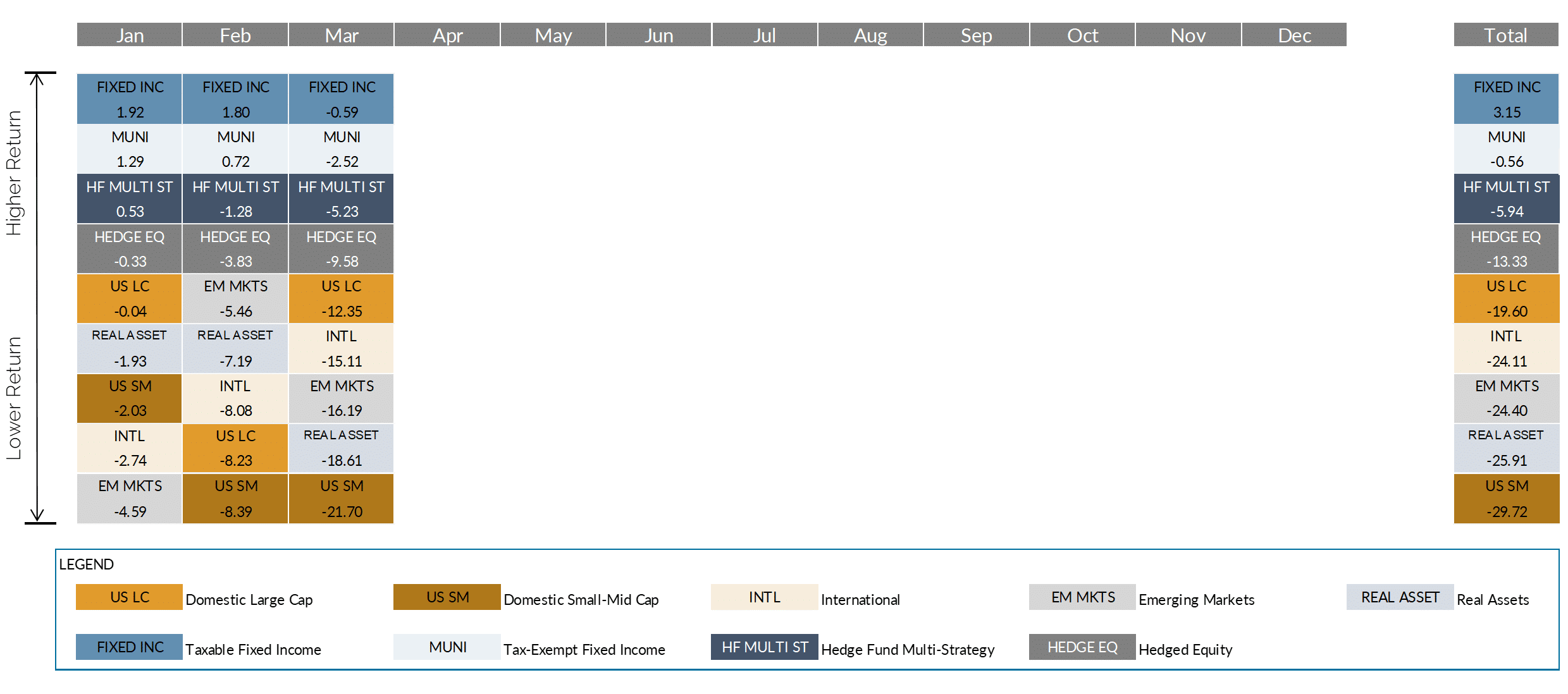

- Equity markets experienced one of their most volatile periods ever. The S&P lost more than 33% in less than five days, for the fastest sell-off ever, only to rebound for one of the best three-day stretches in 100 years.

- U.S. small-mid caps stocks fell nearly 30% in Q1, and finished well behind large cap, as investor exits from all things liquid proved more punitive for smaller companies where there were fewer offsetting buyers.

- International and emerging market equity indices fell nearly 25%, as the virus took hold across the developed and developing world.

- Municipal bonds also fell during the quarter. This was another market that saw significant mutual fund outflows and bouts of illiquidity. For more here, we encourage you to read our recent blog.

- Taxable Fixed Income held up well, but primarily because of Treasuries. Outside of Treasuries, taxable bonds were all lower for the month with parts of the market (e.g. bank loans, high yield corporates, asset-backed securities, and commercial real estate) down well into double digits. Our thoughts on satellite fixed income can also be explored on our blog.

- Alternative investments generally disappointed during the quarter. Those with significant equity exposure fell. Those that came in with less equity exposure, but with tilts to lesser liquid parts of the fixed income market also struggled, with mark-to-market and forced selling weighing on pricing.

- The Fed cut interest rates to zero during the quarter and enacted several Great Recession-era liquidity-enhancing programs. They have also taken an extra step of backstopping parts of the municipal and corporate credit markets. Taking their cue from the Bank of Japan, the Fed can now (if necessary) buy corporate bond ETFs to stabilize liquidity.

- Last, but certainly not least, Saudi Arabia and Russia decided to shock the crude oil market. Failure to agree on output targets resulted in a massive sell-off in crude oil right into one of the biggest demand destruction periods in modern history.

Looking Ahead

This very trying era has led us and our loved ones into uncharted territory in every aspect of our lives – the physical, the personal, and the professional. First and foremost, we hope that you and your loved ones are staying safe.

At the end of 2019 we outlined a calendar of things to look forward to in 2020. It seems like nearly half of them are now cancelled or postponed. The great Summer Olympic distraction will have to wait a year. We are entering a unique period where it is getting harder to lean on precedent. Like it or not, the fiscal and monetary policies enacted today, and the associated backstopping of the economy and asset-prices will translate into evolving debates about Modern Monetary Theory (MMT) and the long-term ramifications of debt, deficits, and markets. In the interim, many of the factors that helped contribute to the last 11+ year bull run remain in place – specifically, suppressed interest rates, an accommodative central bank, aging population seeking yield, and continued technological advancements.

We remain steadfast in this time of great volatility in working closely with our clients to help them plan appropriately and look beyond the short-term. As we continue on in our first full year as Wealthspire Advisors and look out to the decades ahead, we thank you again for the trust you place in us.

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...